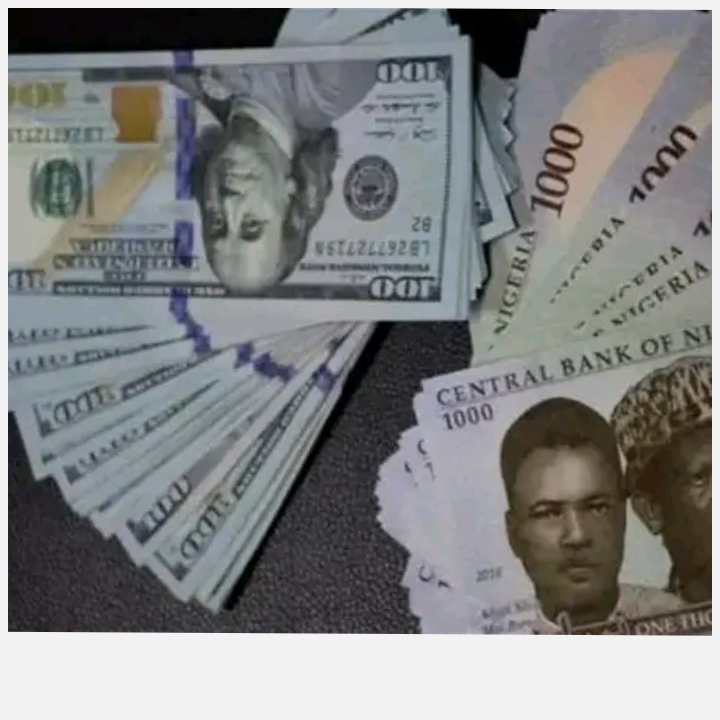

Naira Gains More Momentum Against US Dollar in Official, Parallel Markets

The Nigerian Naira has shown impressive growth against the US Dollar, reaching significant milestones in both the official and parallel foreign exchange markets.

On Monday, the Naira appreciated to N1,136/$ in the official market and N1,050/$ in the parallel market, with traders predicting that it could fall below N1,000/$ before the week’s end.

The rise in value can be attributed to a series of strategic foreign exchange directives from the Central Bank of Nigeria (CBN), which include clearing all valid foreign exchange backlogs—a move confirmed successful by CBN Governor Olayemi Cardoso. These efforts have increased liquidity in the market and restored confidence among investors and traders.

In the official market, the Naira’s value rose by 6.1%, a significant leap from N1,205/$ on the preceding Friday to N1,136/$ on Monday. The intra-day trading saw the Naira strengthening further, with the rate per dollar reaching a high of N1,227 and a low of N1,000, markedly better than Friday’s figures.

Moreover, the CBN has taken additional steps to stabilize the Naira by adjusting the exchange rate for Bureau De Change operators to N1,101 per dollar from a previous N1,251/$, and has plans to distribute $15.88 million among eligible operators. Last month, the CBN also increased the benchmark interest rate by 200 basis points to 24.75%, in an effort to control inflation and stabilize the currency.

However, at the unofficial market, the scene is somewhat different with traders at Wuse Zone 4 expressing concerns over diminishing profits due to the rapid fall of the Dollar. They reported a decreasing demand that has pushed the buying rate below N1,000 and the selling rate to around N1,020.

Despite the challenges at the parallel market, financial analysts and investment companies like Goldman Sachs Group remain optimistic. They have noted the Naira’s position as the top-performing currency globally this April and anticipate further gains due to the CBN’s aggressive policy management, including significant interest rate hikes.